Homegrown Chinese beverage brands – Luckin Coffee, HeyTea, and Chagee – are expanding rapidly into the US market, directly competing with established giants like Starbucks. These chains are bringing a new beverage culture focused on speed, app-based ordering, and distinctive flavors, while Starbucks faces internal challenges, including store closures, layoffs, and union-led strikes. This expansion marks a significant shift in the global coffee and tea landscape.

The Rise of App-First Ordering

Luckin Coffee, China’s largest coffee shop chain with over 26,000 stores globally, is leading the charge. Its US outposts, primarily in Manhattan, emphasize app-based ordering, minimizing human interaction. Customers download the Luckin app, where new users can purchase their first drink for $1.99. Orders are placed digitally, and baristas prepare drinks silently, leaving finished beverages on a counter for customers to retrieve themselves. The system prioritizes efficiency over traditional customer service.

Distinct Beverage Experiences

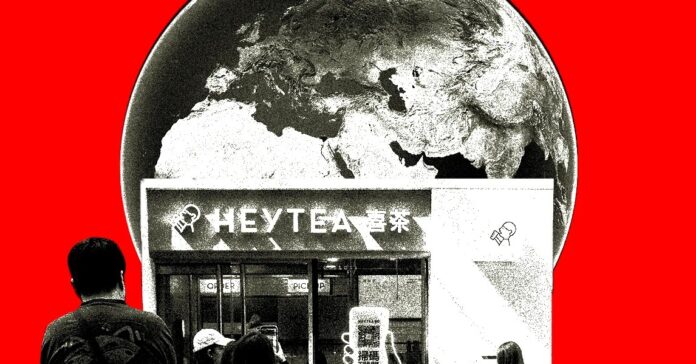

HeyTea, another prominent Chinese brand, offers a different approach. Its Brooklyn store features a monitor displaying ready-to-pickup orders, requiring customers to interact with baristas to collect their drinks. HeyTea is rumored to use higher-quality ingredients in the US than in China, resulting in a stronger tea scent detectable even from nearby storefronts.

Chagee’s Premium Approach

Chagee, founded in 2017 with over 7,000 stores, including 200 outside China, aims for a more welcoming atmosphere. Unlike Luckin’s minimalist service, Chagee stores are designed as comfortable spaces for work, study, or socializing. Despite the ambiance, price points remain competitive with other chains.

Context and Implications

The expansion of these Chinese brands into the US reflects a broader trend of global competition in the beverage industry. Starbucks, while still dominant, is facing increased pressure from both domestic and international competitors. The app-first model adopted by Luckin exemplifies a tech-driven approach to customer service, potentially reshaping consumer expectations. The success of these chains will depend on adapting to local preferences while maintaining their core strengths.

The timing of this expansion is notable, as Starbucks navigates internal challenges and labor disputes. The influx of new competitors could further disrupt the market, forcing established players to innovate or risk losing market share. The long-term implications of this trend remain to be seen, but the arrival of Chinese beverage chains signals a new era in the US coffee and tea landscape